Blockchain's role in the global distribution of power

Innovations that enable efficient distribution of information or wealth can change the world. Think of the internet and our banking system. I believe the internet enables a constant, gradual change in power structures through stimulating distribution of information.

Society and the economy are constantly changing. Now faster than ever before.

The rate of change in society we’ve seen over the past decades is unheard of. As a result, our cultural evolution is being warped and accelerated through the new uses of technology. Obvious examples of this are smartphones, social media, and instant messaging.

A sometimes overlooked impact of technology, apart from changing the way we interact, is the role that it plays in the power structures of our ever-growing information society.

Informational power

Take informational power for example, which is power gained through information that others need or want. Informational power is effectively becoming more and more distributed through new mediums like the Internet. Nearly everyone can share and copy their information freely through dedicated online software. More specifically, the increasing distribution of informational power seems to be a process similar to diffusion; high concentration moves gradually to lower concentration areas, causing a more evenly distributed whole.

Valuable information is becoming increasingly public, and we’re gradually moving away from centralized informational power that still incorporates the concept of censorship of information. Censorship of information is one of the problems blockchain tries to solve through censorship resistance, by allowing anyone to transact and making transactions generally immutable.

As a result, this distribution of informational power allows other forms of power to become more distributed as well. Examples of this are status and money, as it is easier than ever for anyone to gain a following or sell their services through the internet and social media platforms. Nearly everyone can transform the gigantic amount of available information into something useful, and can, in turn, be rewarded with status (following) or money as a result.

Hierarchy and politics

Yet another impact of technological advancement relates to the establishment of hierarchy and political constructs. As information is constantly becoming easier to share, the alignment of people can change more rapidly as information is shared more efficiently and with more people at the same time.

A good example of the impact of our information society on political constructs is Trump’s campaign, which was heavily relying on social media like Facebook. As Brad Parscale, the digital media director for Trump’s campaign, said:

“... we needed to go out and find millions of people to be our supporters and Facebook allowed us to do that in alarming numbers, very fast” - Brad Parscale on CNBC

The Internet

The internet is playing a big role in this, as it is actively replacing our traditional distribution of information (letters, magazines, newspapers, television). The ability to easily do online payments, watch series on-demand, and use social media at every time of the day are examples that indicate our distribution of information is radically different from 10 years ago.

The ease with which we accumulate information, and the ease of sharing this information in a modern context are strong indications of our growing ability to give and take power through increasingly small actions. This is part of our motivation to implement social trading.

We are all constantly part of the distribution of power: using products from companies that utilize our data, liking someone’s post, paying for an article online, or getting ‘claps’ on Medium. But it is also active on other levels in your life: even greeting someone in a crowded place, or looking a certain way, is part of (social) power distribution. The list goes on.

Overall, the advent of technology seems to be stimulating the diffusion of power. Next, I’d like to focus on the role that the blockchain has in this pattern of global power distribution.

Blockchain: the new value distribution

This movement of power we see with information is slowly happening with money as we speak.

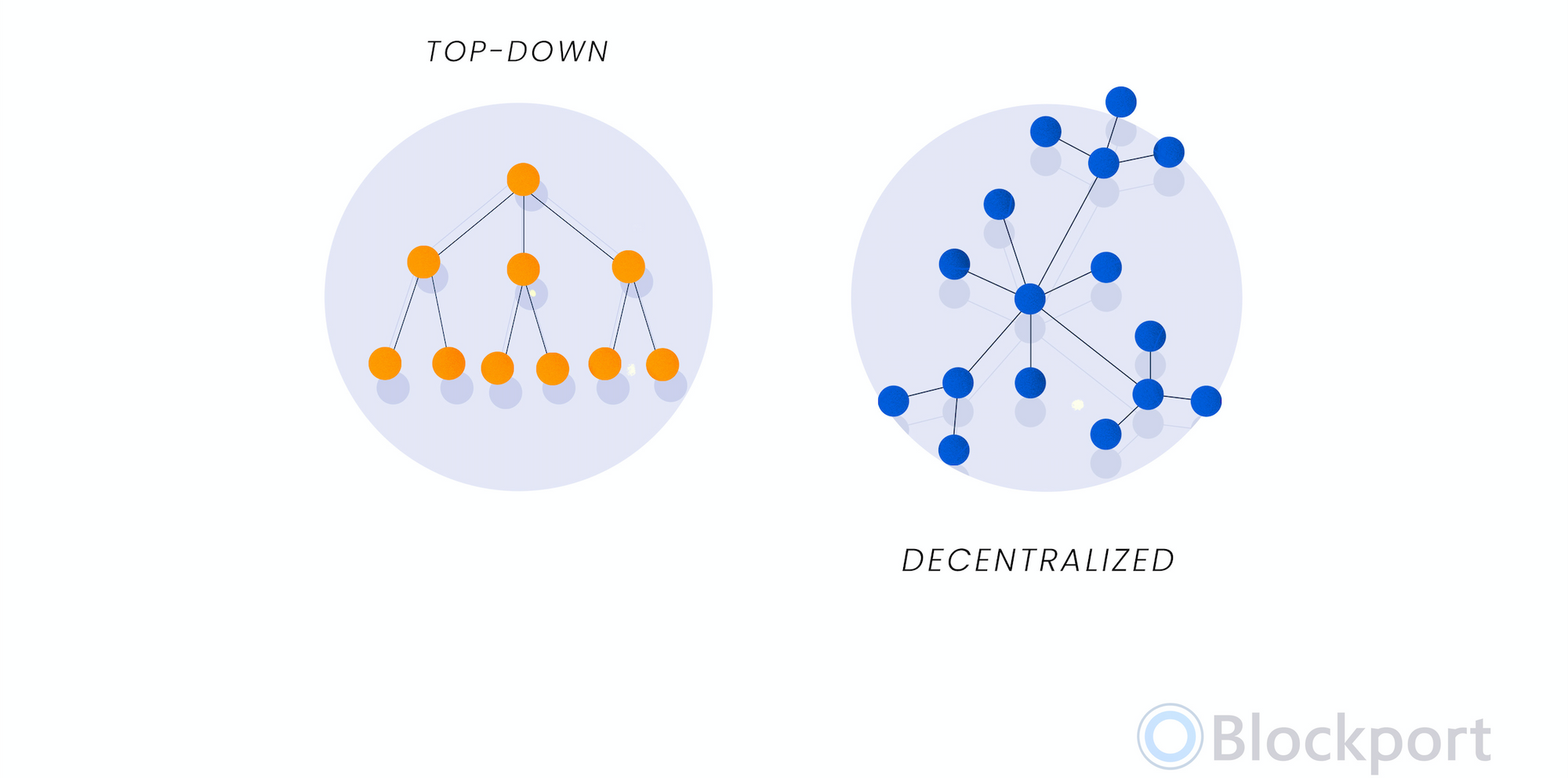

Blockchain-like protocols have the ability to replace our current distribution of value. As noted, in the past both value and information were generally governed by those who had the power to distribute it to others. Today, nearly everyone can distribute their information freely.

However, value is currently still governed by those who have the power to distribute it to others, because they can guarantee the ‘integrity’ of information - the reassurance that everyone involved can be certain a piece of information is trustworthy, like the balance on your bank account.

The inception of our banking system was (and still often is) a great first step of power distribution that had a major impact on our ability to evolve our society. Part of this evolution is tied to the Rothschild family, which had a big role in the evolution of banking and money during the industrial revolution. They, too, had a tight-knit system of power through which they helped create the world of banking as we know it.

Right now, a comparable combination of technological revolution and economic shift is happening. As a natural result of this tendency of technology to stimulate the diffusion of power, in the future, everyone will become able to distribute their value freely through decentralized networks and markets built on top of them.

Organizations like Blockport, and their fat protocols

Brands and hubs like Blockport will eventually exist to distribute the accessibility of value through shared protocols, but without holding the actual value and information that is distributed.

The division between the applications or organizations, and the protocols that they build upon, will start to look different as value is being created and managed by protocols more consistently. In different wording, protocols become ‘fat’ as they are taking more responsibility out of our hands. This is part of the ‘fat protocol’ thesis, as shown below:

The fact that we are becoming increasingly reliant on public protocols, instead of applications or organizations that are managed by a centralized group of people, will result in a more consistent diffusion of information and value. This means both distribution of information and distribution of value will become more autonomous processes, left to the hands of our global society to manage and foster.

In the end, this process of power diffusion from high concentrations to lower concentrations is a continuous one, and will therefore continue to make our society more efficient in cycles.

Much of the value that is now created by organizations that consist of centralized groups of people, will be originating from protocols. Investors, but essentially anyone in the world, can invest in tokens that are linked to the optimal performance of the protocol itself, instead of traditional investments that are linked to the performance of an organization.

We believe in a strong network of organizations, both public and private, to properly manage and balance this innovation.

What will blockchains and cryptocurrency do for us in the future?

Technological innovations are consistently delivering more capabilities for interconnectedness, and engineering is advancing to a level that allows a global interconnected network of open services that can be tightly integrated. A truly future-oriented way of engineering a large system, is akin to that of nature itself, with many interconnected components adapting and individually evolving.

To scale the integration of blockchain and cryptocurrency to a global level, the ability for new and existing projects to adopt this technology and integrate it with our current system of money is necessary. A user should have the ability to start utilizing a new decentralized application without having to deal with high barriers of entry - and ideally, even basic knowledge of decentralization - like creating keys.

Building applications and markets in a decentralized way brings forth a new world of opportunity: through companies like Blockport, consumers will be able to invest in and seamlessly utilize decentralized projects that are integrated with chains we support. Information, money, and control will be in the hands of users, whatever application they use.

With a level of integration like this, it will become entirely possible to create new forms of collaboration. Reward structures can be reinvented through the use of micropayments and products can be built on networks of value exchange instead of being dependent on external integrations (as cryptocurrency is ‘programmable money’).

The concepts of trust in how we distribute information and value will gain a new meaning. People can express what they believe in through other means of voicing an opinion online: by becoming part of a new micro-economy. A micro-economy they are an equal part of, in which they are rewarded for participation, and one that can increase the value of its currency by providing value for others in this world.

As Aaron Swartz, founder of Reddit, once put it:

"We need to take information, wherever it is stored, make our copies, and share them with the world." - Aaron Swartz, Guerilla Open Access Manifesto

This can bring people together globally as the internet did but built on a network of value exchange that combines the exchange of value with real purpose. People can support new purposes, find more meaning and create more means of improving the world we live in through the natural effect of public- and autonomous markets.

Move forward: integration and adoption

Enabling our international and global financial system to integrate new technologies like cryptocurrency into it, is an essential step forward. Our ability to engineer trust into the systems we use every day can be - and I believe should be - safely adopted by our society and economy.

Looking at the trend so far, we can expect significant progress over the coming years:

● In 2011, the crypto market cap peak reached over 100 million dollars and over 70.000 wallet users;

● By the end of 2013, the market cap peak was over 13 billion dollars with a little under 1 million wallet users;

● In 2017, the market cap peak was nearly 300 billion dollars with over 20 million wallet users.

Source: Blockchain.com: https://www.blockchain.com/en/charts/

The next wave could see a market cap in the trillions and millions of new users, which is covered in more depth in another article on our blog.

The more we gradually distribute power, the less it will be taken by force.