Summary of Ray Dalio's 'Changing world order'

From: https://www.youtube.com/watch?v=xguam0TKMw8&ab_channel=PrinciplesbyRayDalio

I like making summaries, and notes. I figured I can publish some of them. So here's one on a cool macroeconomics video from Ray Dalio:

What happened in the past, can happen in the future. Especially economic cycles with central banks; the system structure didn't change much, so it's just a system cycle we're on. We have had central banks and governments operating for a very long time.

I think system changes that can alter feedback loops in the system (e.g. bitcoin) are bound to come, and this is something to keep watching.

He describes the process:

- Countries default on debts. Even after interest rates are 0. Then they start printing more and more money.

- Internal conflict emerges due to the growing wealth gap. Left (redistribute wealth) and right (defend those holding wealth) clash.

- External conflict between leading power and emerging power, like now with US and China.

External world orders change after wars.

The Bretton Woods system, set up in 1944, was the agreement establishing the US world order with USD as a reserve currency. This was a key moment in history for the establishment of the new world order.

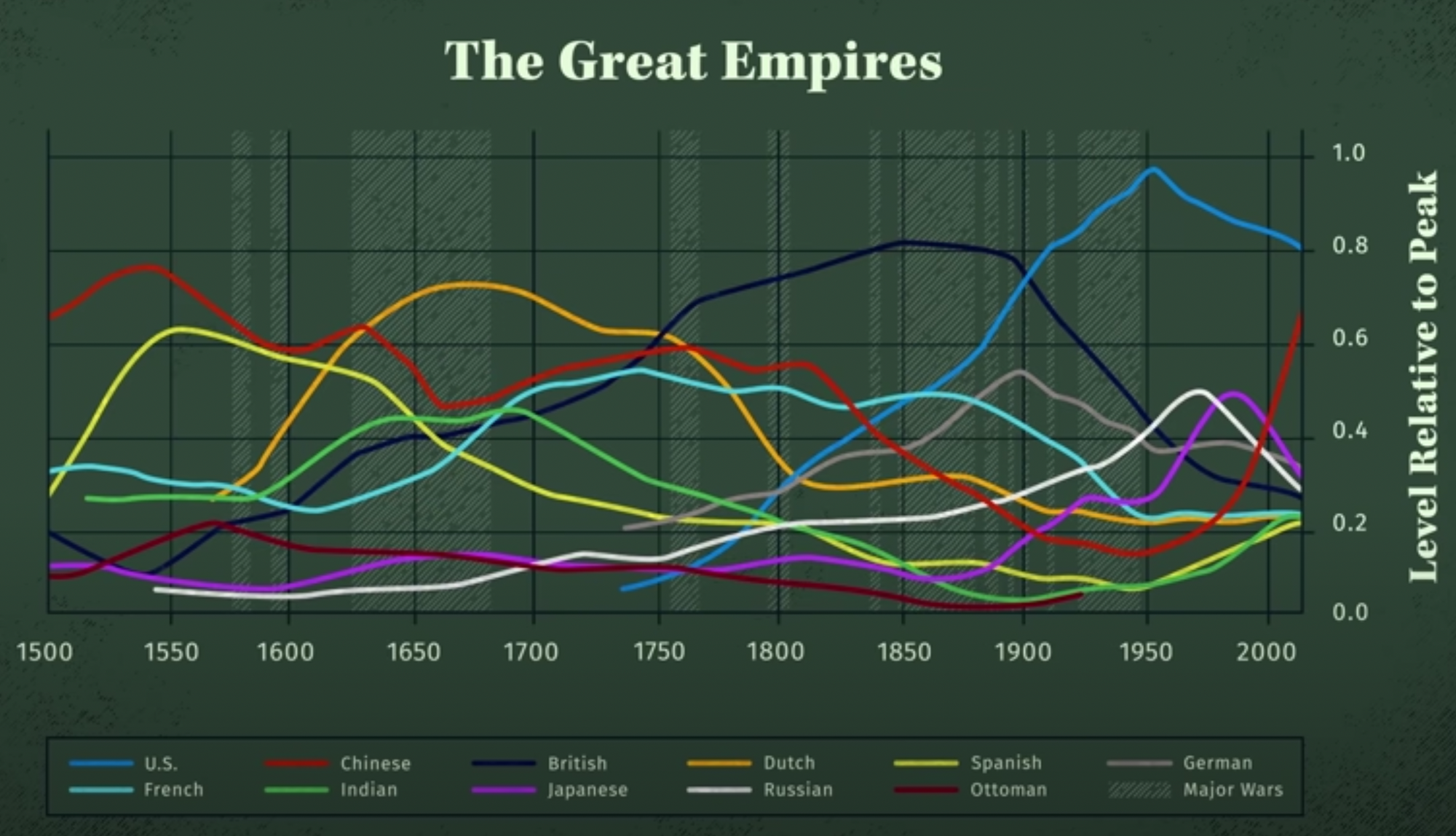

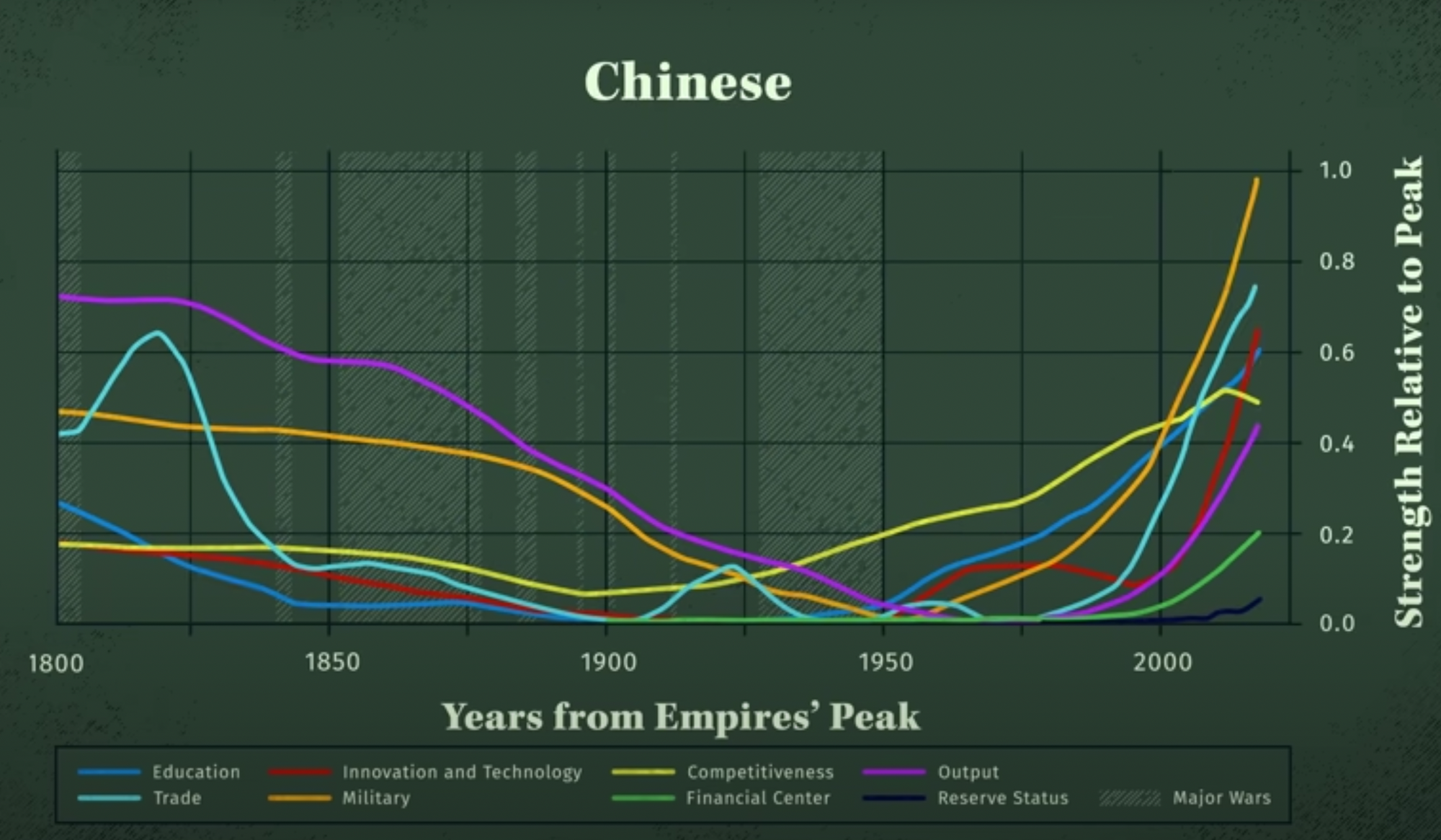

Comparing countries

The rise and fall are heavily correlated. Education oftentimes causes innovation and trade, which in turn causes competitiveness and output, which can result in the financial center/reserve status/military.

The Rise: steps to power

- Win power by gaining more support than opposition.

- Consolidate power by converting, limiting, or weakening the opposition.

- Establish systems and institutions that make things work well.

- Pick successors well. A great empire requires many great leaders over time.

Dutch came up with a quarter of all major inventions in the world (at least in 2022, according to Ray Dalio..). Most important: ships and capitalism.

At some point, the currency of a dominant world power becomes a preferable store of value.

For a currency to grow:

- As a country grows big, transactions can be paid in its currency worldwide.

- Because it's accepted worldwide, people want to save in it.

- Then it's a reserve currency.

Then, everyone wants to save in their currency and is happy to lend it back to the issuing country. The trust in the institution increases so everyone is happy to buy government bonds!

The peak

Balancing feedback loops are active here.

- The world power is more expensive, relatively speaking, as it has more money. This makes it less competitive, so cheaper labor is sought.

- Other countries copy technologies and produce/sell them more cheaply which reduces competitiveness. In a global economy, this is part of a balancing feedback loop.

- People that become richer, don't work as hard. Then focus on the 'nicer things in life'. They then become decadent in extreme cases.

- Their kids, because of comfortable circumstances, have a higher chance of becoming complacent and a lot less resilient. E.g. the golden era of the Dutch, or the Victorian era of the British.

- They will borrow more because they bet on the stability and rise to continue. Little do they know, they're just living a cycle. This creates a bubble.

- The wealth gap grows more and more, as there is always unevenness in systems. This is greatly enhanced by the bubble as the state of markets is a multiplier.

- Countries end up financing domestic overconsumption through means of massive borrowing and inflation-induced spending. However, the actual economic growth and income are not on par with the level of borrowing and spending (this is what we're seeing now in the West). On top of this, additional costs are made to maintain military power, relative to the size of the power (larger = more spending)

- At this point, the empire is simply not profitable and becomes bureaucratic. This increases internal and external friction and chances for escalation: war.

- Naturally, the world power ends up borrowing from the poorer (competing) countries that save more. This is easy because the lending country already has the dollar. This borrowing happens often through the issuing of government bonds.

- Because of all these effects, people are closing their 'positions' in the reserve currency, looking for other stores of value.

The decline

- As the economic situation declines, conflict increases.

- The country, desperate to maintain some stability, starts printing money (inflation), digging its own hole further. First gradually, and eventually massively.

- For the Dutch and British, this was the repayment of war debt. For the US, it's 3 cycles of 'Boom and bust': dot com bubble, mortgage crisis, and pandemic.

- Internal conflict increases even more. Political extremism increases, and populism rises.

- When the rich feel threatened, they will move their assets ASAP. This reduces income for the world power since domestic economic activity (taxable events) further decreases. This creates a feedback loop: more inflation needed, more friction, more fear, more fleeing, more inflation.

- Populist leaders rise. Dictatorship on the loom.

- These crises make the world power temporarily very weak, increasing external risks (other countries invading).

- There is basically no money to spend on the military at this point. War ensues.

- A new power is established.

Since currencies are actually forms of debt, as the currency falls, debt is reset.

Right now

- Dollar sell-off has not begun yet (2022-05-31).

The future

It depends! A country has to look at its own vital signs and act!

A nations greatest war is with itself.

The only two things we have to do:

- Earn more than we spend

- Treat each other well